Your Money, Your Right: Reclaiming Unclaimed Financial Assets

The Government of India has introduced a transformative initiative named “आपकी पूँजी, आपका अधिकार — Your Money, Your Right.” This program is designed to assist citizens in reclaiming their unclaimed financial assets. These assets encompass unclaimed bank deposits, insurance payouts, dividends, shares, mutual funds, and pension amounts that have remained inactive for various reasons, such as account dormancy, policy lapses, or a lack of awareness.

Launched on 4 October 2025, this initiative is founded on a robust 3A Framework — Awareness, Accessibility, and Action. This framework ensures that every eligible citizen can easily locate and claim their rightful money.

Objectives of the Campaign

The nationwide drive, which runs from October to December 2025, aims to:

- Raise awareness about unclaimed financial assets

- Enhance accessibility through digital tools and district-level outreach

- Facilitate action by helping citizens in filing claims quickly and accurately

This initiative underscores the government’s commitment to financial inclusion, transparency, and the protection of citizens’ wealth.

Implementation Across India

The campaign is being executed in every State and Union Territory, ensuring widespread national participation. Key highlights from October to 5 December 2025 include:

- Camps organized in 477 districts across India

- Participation from public representatives, district administrations, and financial institution officials

- On-ground arrangements featuring digital demonstrations, helpdesks, and guided support for filing claims

- Awareness materials released in major regional languages, including SOPs, FAQs, and video messages

This grassroots-level approach guarantees that even citizens in remote areas can access their unclaimed funds effectively.

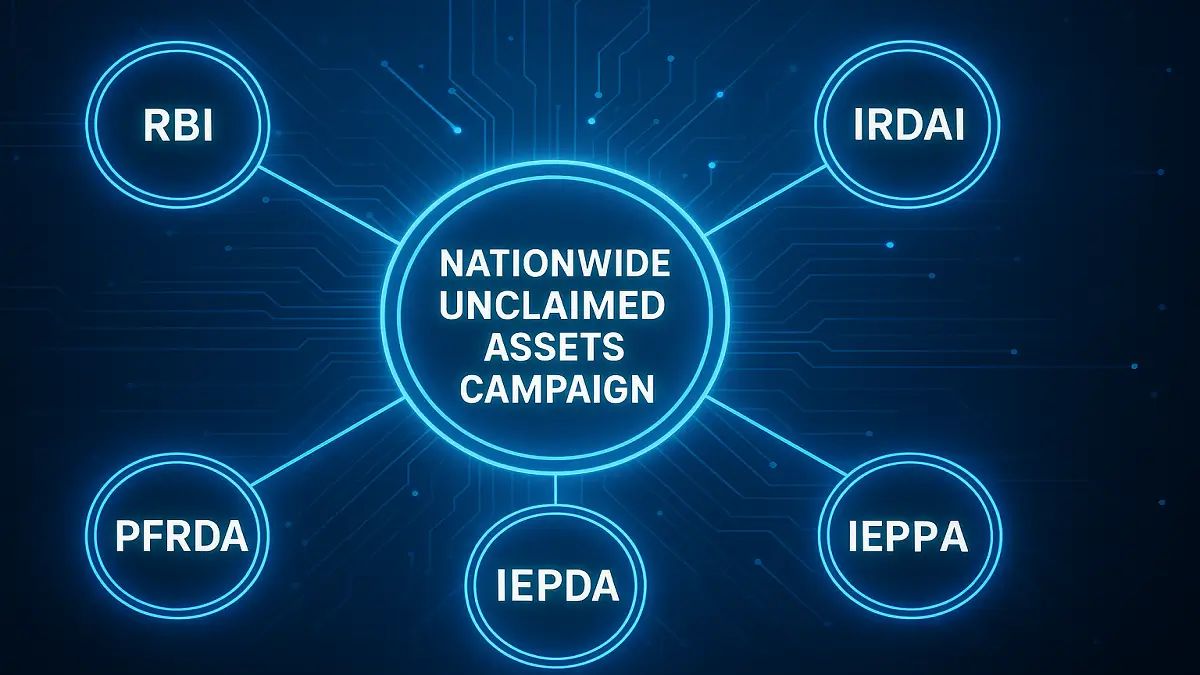

Collaboration with Major Financial Regulators

The campaign involves coordinated efforts from all major financial regulators, including:

- Reserve Bank of India (RBI)

- Securities and Exchange Board of India (SEBI)

- Insurance Regulatory and Development Authority of India (IRDAI)

- Pension Fund Regulatory and Development Authority (PFRDA)

- Investor Education and Protection Fund Authority (IEPFA)

This multi-agency collaboration strengthens the verification and settlement of claims, making the process smoother for citizens.

Frequently Asked Questions (FAQs)

Q1. What is the main goal of the "Your Money, Your Right" initiative?

Answer: The primary goal is to help citizens reclaim unclaimed financial assets, ensuring that they can access funds that may have remained dormant due to various reasons.

Q2. How long will the campaign run?

Answer: The campaign will run for three months, from October to December 2025, aiming to reach as many citizens as possible during this period.

Q3. What types of assets can be reclaimed under this initiative?

Answer: Citizens can reclaim various assets such as unclaimed bank deposits, insurance proceeds, dividends, shares, mutual funds, and pension amounts.

Q4. How is the campaign being implemented nationwide?

Answer: The campaign is being conducted in all States and Union Territories, with camps set up in 477 districts to provide assistance and information to citizens.

Q5. Which organizations are collaborating in this initiative?

Answer: Major financial regulators like RBI, SEBI, IRDAI, PFRDA, and IEPFA are collaborating to strengthen the verification and settlement of claims.

UPSC Practice MCQs

Question 1: What is the framework supporting the "Your Money, Your Right" initiative?

A) Awareness, Accessibility, and Action

B) Awareness, Action, and Assistance

C) Accessibility, Action, and Assessment

D) Awareness, Accountability, and Action

Correct Answer: A

Question 2: When was the "Your Money, Your Right" campaign launched?

A) 4 October 2023

B) 4 October 2024

C) 4 October 2025

D) 4 October 2022

Correct Answer: C

Question 3: How many districts are involved in the campaign?

A) 500

B) 400

C) 450

D) 477

Correct Answer: D

Question 4: What types of financial assets can citizens reclaim?

A) Only bank deposits

B) Only insurance payouts

C) Various types including bank deposits and mutual funds

D) Only shares and dividends

Correct Answer: C

Understanding the Digital Personal Data Protection Rules, 2025

Transforming India's Criminal Laws: A Deep Dive into Recent Reforms

Right to Information Act: Ensuring Transparency in Governance

Understanding the Jan Vishwas Act 2023: A Step Towards Decriminalization

Understanding Criminal Law Bills and Their Decolonization Impact

Article 51A: The Call for Excellence in Citizen Responsibilities

Historical Importance of 26th November in India

Kutos : AI Assistant!

Kutos : AI Assistant!

Ask your questions below - no hesitation, I am here to support your learning.